Cumulative Volume Delta (CVD)

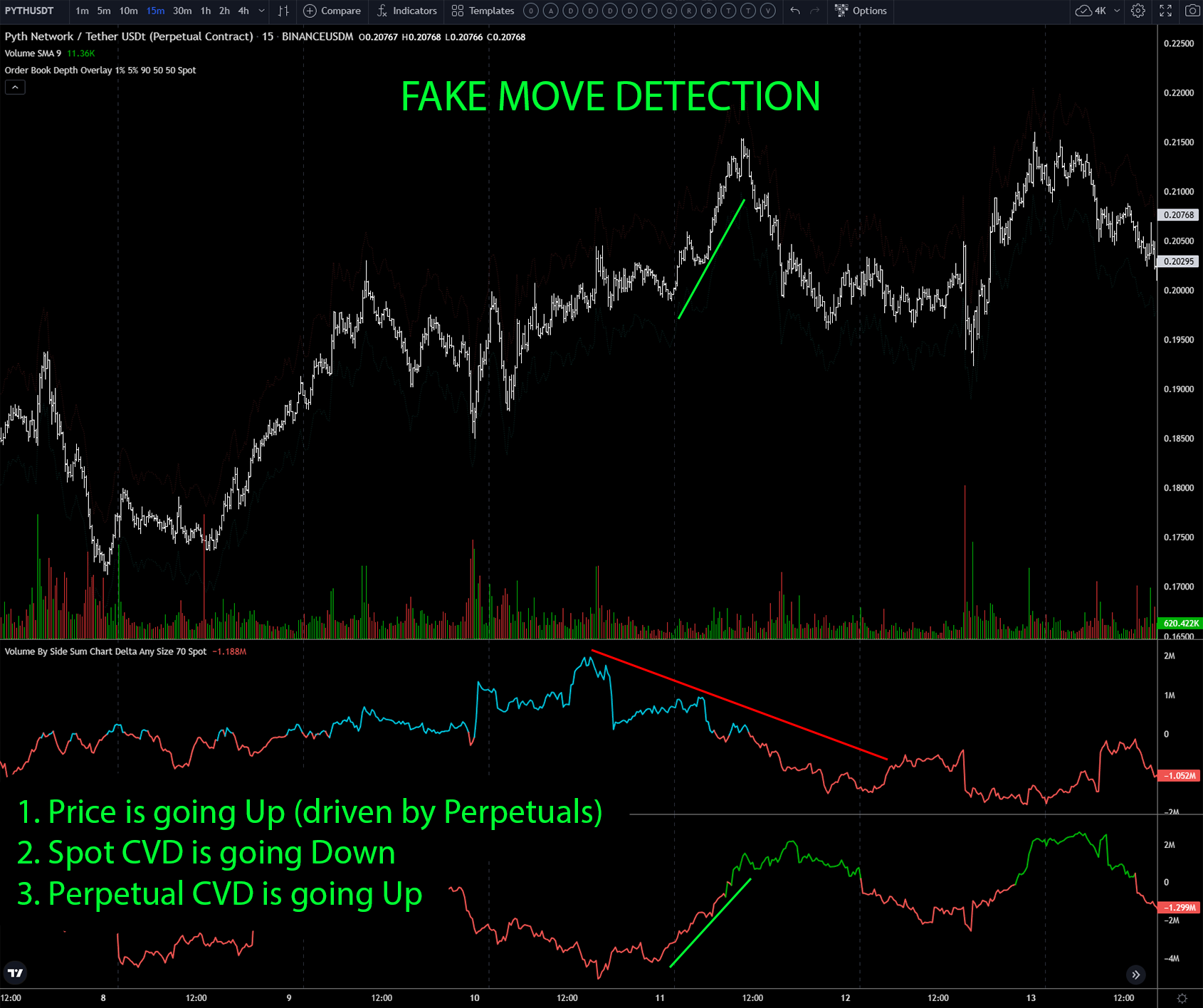

CVD Types

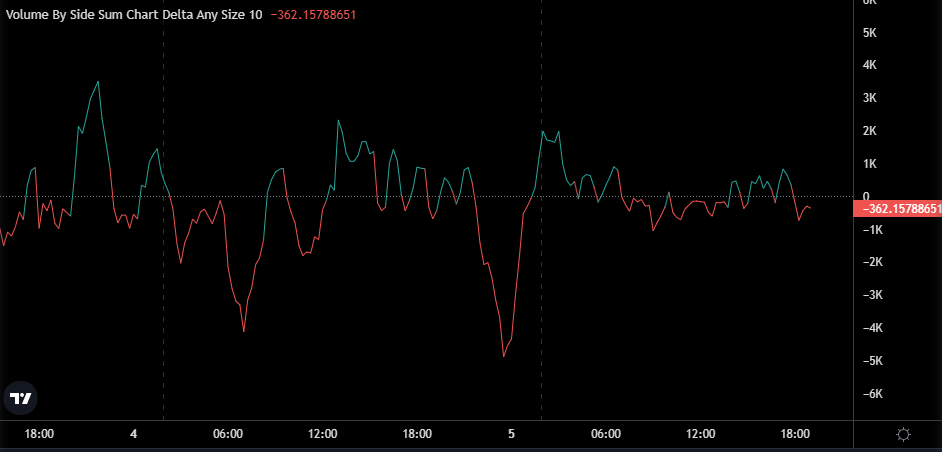

CVD Settings

How to Use CVD in Trading?

Simple Strategies for Using CVD

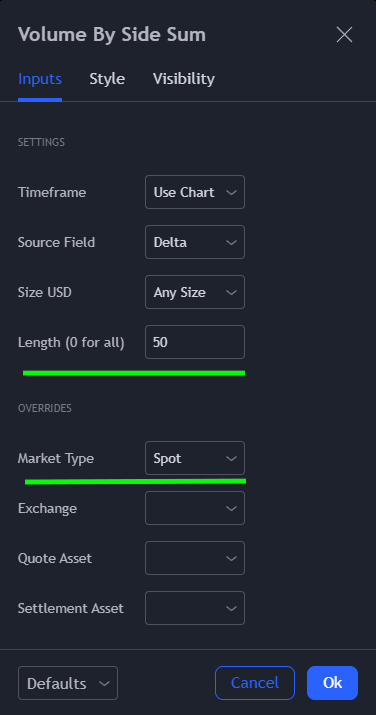

1. Movement Confirmation (Both CVDs vs. Price Convergence)

2. Reversal or Exhaustion Detection (Spot CVD vs. Price)

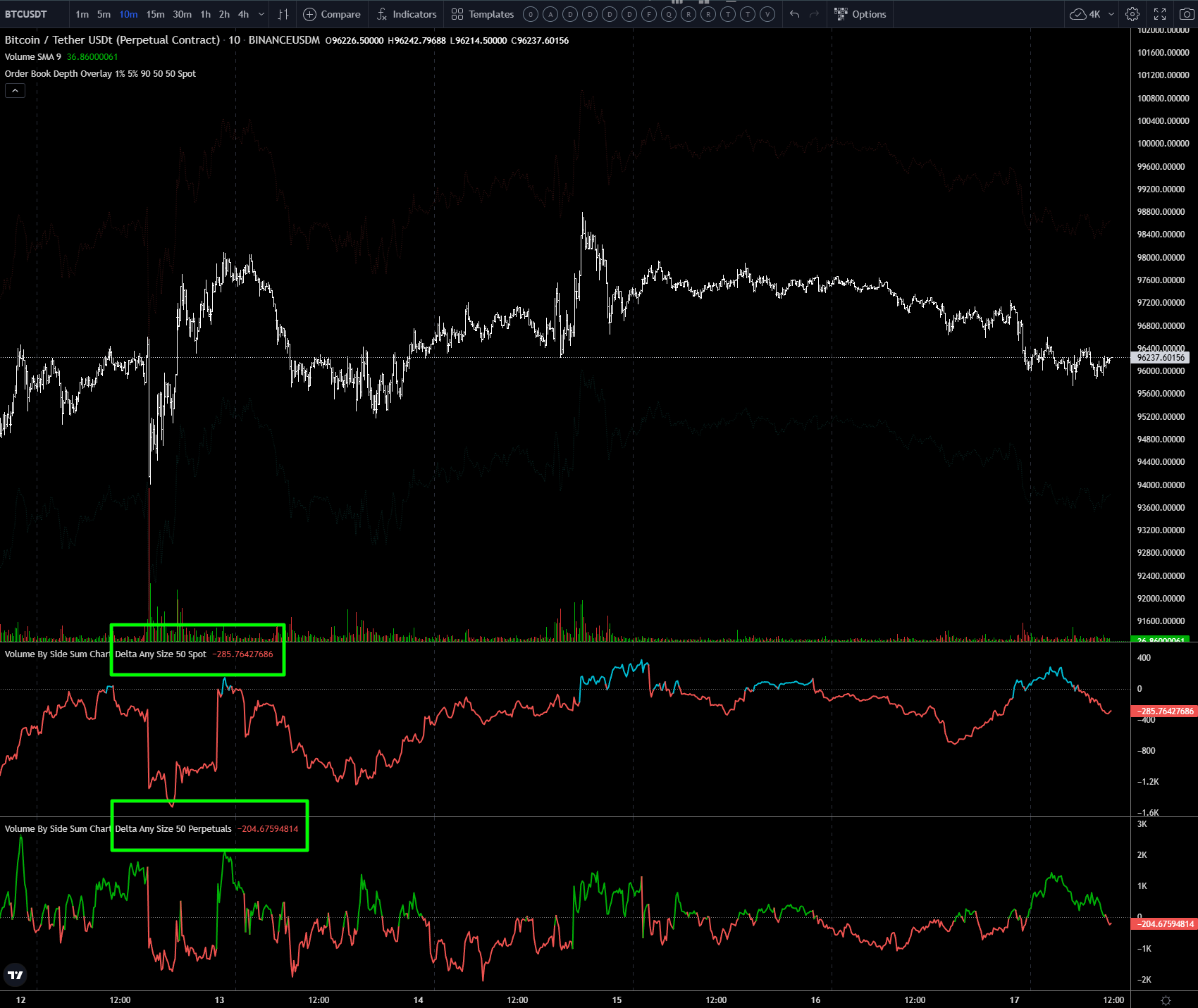

3. Fake Move Detection (Spot CVD vs. Perpetuals CVD)

4. Range-Based Hidden Buying/Selling

5. Uptrend/Downtrend Absorption

Key Takeaways:

Last updated