Long/Short Ratios

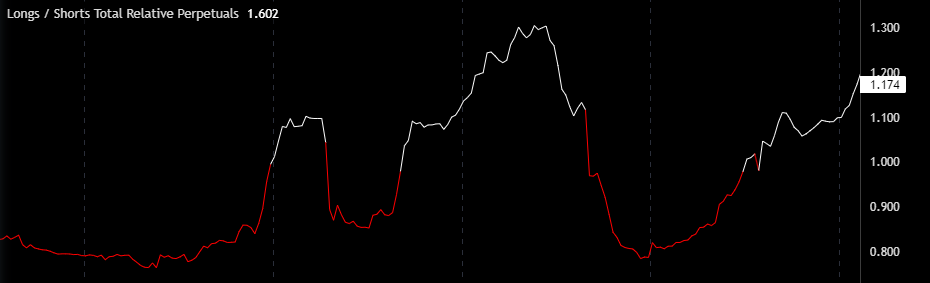

The Long/Short Ratios indicator provides a real-time snapshot of trader positioning across major futures exchanges, including Binance Futures, Bybit, and Bitfinex. By analyzing the distribution of long and short positions, traders can gauge market sentiment, potential liquidity zones, and evolving trader expectations.

The ratio is determined by dividing the total number of long positions by the total number of short positions:

Example: If there are 80 long positions and 40 short positions, the Long/Short Ratio is 2 (80/40), meaning there are twice as many long positions as short ones.

Available Long/Short Ratio Views (Binance Futures Only)

TRDR provides three distinct views of the Long/Short Ratios, each offering a different level of market insight:

Represents the proportion of net long and net short accounts relative to the total number of accounts with open positions.

Formula: Long Account % = Accounts with net long positions / Total accounts with open positions Short Account % = Accounts with net short positions / Total accounts with open positions Long/Short Ratio = Long Account % / Short Account %

Purpose: Provides a broad market overview, helping traders assess overall bullish or bearish bias.

Focuses on the top 20% of traders with the highest margin balances, revealing how experienced or well-capitalized traders are positioned.

Formula: Long Account % = Top trader accounts with net long positions / Total top trader accounts with open positions Short Account % = Top trader accounts with net short positions / Total top trader accounts with open positions Long/Short Ratio = Long Account % / Short Account %

Purpose: Helps identify whether whales and institutional traders are aligned with or diverging from retail traders.

Unlike the Top Trader Accounts Ratio, which considers individual accounts, this metric evaluates the actual volume of positions held by top traders.

Formula: Long Position % = Total long positions held by top traders / Total open positions of top traders Short Position % = Total short positions held by top traders / Total open positions of top traders Long/Short Ratio = Long Position % / Short Position %

Purpose: Determines whether institutional traders are heavily skewed toward long or short positions, providing insights into potential market trends.

The data can be expressed in two ways:

The Long and Short Ratio can reveal the current positioning of retail traders (long or short) and their potential reactions to price shifts. This understanding can indicate possible liquidity areas, such as stop loss or liquidation zones, contributing to a comprehensive trading strategy.

Last updated