💬Sentiment Indicators

Sentiment indicators help traders analyze market positioning, risk appetite, and potential price shifts by tracking trader behavior in derivative markets. These indicators provide insights into market sentiment, allowing traders to anticipate trend continuations, reversals, or liquidation events.

Key Sentiment Indicators:

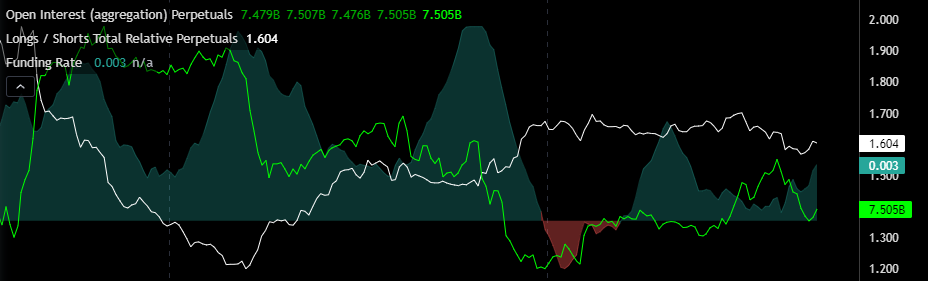

Long/Short Ratios – Show the ratio of long to short positions, helping identify bullish or bearish market bias and potential overcrowded trades.

Open Interest (OI) – Measures the total number of open futures contracts, indicating liquidity, market participation, and trend strength. Rising OI suggests increasing trader commitment, while declining OI signals position unwinding.

Funding Rate – Represents the cost of holding long or short positions in perpetual futures. Positive funding means long traders are paying shorts, suggesting a bullish bias, while negative funding indicates shorts are paying longs, signaling bearish sentiment.

By analyzing sentiment indicators alongside order book data, volume flow, and liquidation levels, traders on TRDR can make more informed decisions and improve risk management strategies.