Creating an Alert

Let's start to create an Alert! 🚀

Press Create label

Press the Create label and define the specific market conditions that will trigger alerts.

Expiration

Users with an active subscription no longer have their alerts expire. When a paid subscription ends, or if a free user has been inactive for some time, the system will automatically pause any alerts.

Sharing an alert

Alerts can be shared to other people in TRDR. Click to the share icon, and activate the “Shared” switch. Then copy the link and share it.

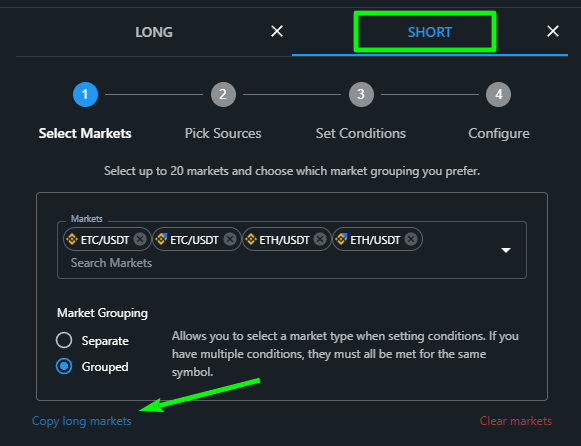

Long and Short Tabs

The Alerts widget has two main sections: Long and Short. These correspond to market directions. For example, a Long alert might trigger when certain bullish conditions are met, while a Short alert would trigger for bearish conditions. You can configure alerts independently for each direction, or copy settings between the two for efficiency.

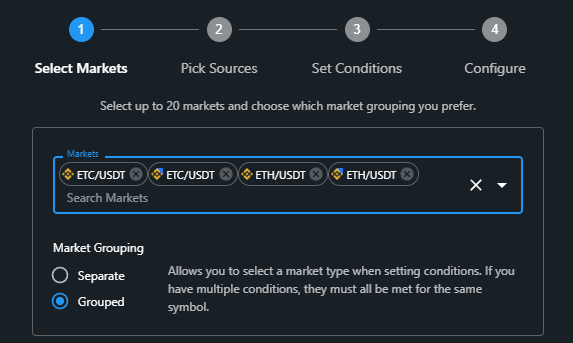

1. Select Markets

We will do a Market selection using the Long tab as an example.

Markets (Futures, Spot)

Choose a Market type. Alerts can be set for both Spot and Futures markets. Take care to select the right Exchange and have not confused the Spot market with USD-M or COIN-M markets.

Market grouping (Separate, Grouped)

Choose a Market grouping.

Separate — this is the default option. Conditions will be checked for each market separately.

Grouped — allows you to select a market type when setting conditions. If you have multiple conditions, they must all be met for the same symbol.

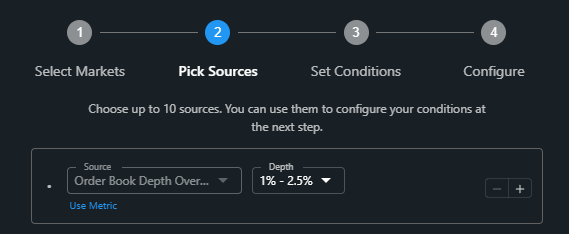

2. Pick Sources

Select the required sources.

Difference between Single and Aggregation

Single source — provides data from a single exchange and single market.

Aggregation source — provides data from multiple exchanges into a single aggregated source. You can choose which exchanges you want to track and which not.

Different sources can have different settings, like: Timeframe, Depth, Type, Market type, Quote assets and Settlement Assets. They have a direct impact on the final value.

Click the “+” button to add a Single or Aggregation data source manually. Alternatively you can press the “Copy chart sources” label to copy all data sources (indicators) available on your current chart.

Funding Rates

Track funding rates on perpetual futures, helping traders spot shifts in market sentiment.

Liquidations

Track liquidation volumes to identify potential reversals or periods of high volatility.

Longs/Shorts

Set alerts based on shifts in long or short positions, which could indicate a change in market sentiment.

You can choose between the:

Total — is a sentiment analysis indicator that relates to market participants' opinions and actions. It is calculated by dividing the number of long positions by the number of short positions. A high ratio suggests bullish market sentiment, while a low ratio suggests bearish market sentiment.

Top Trader Accounts — the proportion of net long and net short accounts to total accounts of the top 20% users with the highest margin balance.

Top Trader Positions — the proportion of net long and net short positions to total open positions of the top 20% users with the highest margin balance.

OHLCV

Monitor standard price and volume data, including Open, High, Low, Close, and Volume.

Open Interest

Open Interest (OI) is a key market metric that represents the total number of outstanding derivative contracts (futures or perpetuals) that have not been settled. Unlike trading volume, which measures the number of contracts traded in a given period, open interest reflects the total active positions in the market at any given time.

Order Book Depth Cumulative

Monitor liquidity by tracking how much of the Order Book is filled at different percentages (ranges), starting from the highest Bid and lowest Ask.

You can choose between: 0% - 1%, 0% - 2.5%, 0% - 5%, 0% - 10%, 0% - 25%.

Order Book Depth Noncumulative

Monitor liquidity by tracking how much of the Order Book is filled at different percentages (ranges), separated by Order book percentage segments.

You can choose between: 0% - 1%, 1% - 2.5%, 2.5% - 5%, 5% - 10%, 10% - 25%.

Order Book Depth Overlay

Similar to the Order Book Depth Noncumulative, but used mostly to confirm the Order Book Depth percentage by the simple visual chart inspection.

Order Book Top Levels

Track the price approach to the biggest Bid or Ask price levels by defining Deviation from price or Level Changes.

Price

Simple current price value.

Volume by side

Track changes in the Bid, Ask, Total, Delta or Ratio traded volume.

Metrics

By clicking the “Metrics” link you can apply different Indicators (RSI, MACD, etc.) to a source and use the metric as a source of data.

For example, you can add an RSI to Open Interst:

Or add Cumulative Volume Delta as a separated metric (make sure to choose "Volume By Side" and "Sum" in this case):

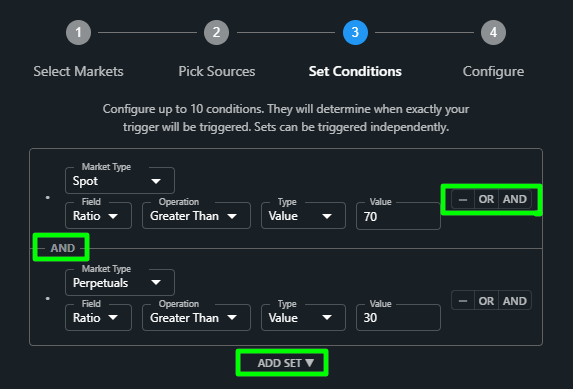

3. Set Conditions

Conditions will determine when exactly your trigger will be triggered. You can configure up to 10 conditions and group them in Sets.

Sets

A Set is a group of conditions. You can Add/Remove sets to monitor more data independently. If you have few sets — they will trigger independently.

Logical operators AND, OR

You can set an alert that only triggers when multiple conditions are met simultaneously.

AND — splits the set into the parts. Each condition must be true to trigger.

OR — any condition of the set must be true to trigger.

Field and its relationship with the selected source

By clicking the “Field” you have a list of ALL sources you have selected previously and ALL their properties:

Bids, Asks, Delta and Total — are expressed in USD if your source uses aggregation and in COINS if it doesn't use it.

Ratio — is expressed as a percentage from -100 to 100 regardless of the aggregation.

If you have configured a condition, you cannot delete the source from the “Pick sources” tab until you will not delete the condition depending on it.

Operation types:

Crossing

A basic alert that triggers when the current price or value crosses a specified value, regardless of the direction (up or down).

Crossing Down / Crossing Up

Similar to Crossing alerts but allows you to specify the direction of the price movement.

Greater Than / Less Than

Alerts triggered when the price or value surpasses or falls below a set value, indicating a significant price movement.

Entering Channel / Exiting Channel

Alerts that notify when the price enters or exits predefined price channels, which can help identify significant price moves.

Inside Channel / Outside Channel

Alerts based on whether the price is within or outside a defined channel range.

Moving Up / Moving Down

Alerts that consider not only price movement but also the time it takes for the price to change by a specified amount.

Moving Up % / Moving Down %

Similar to Moving Up / Moving Down alerts, but based on percentage changes in price, making it easier to set targets.

Value

Can be positive or negative. For the short conditions you will often use negative.

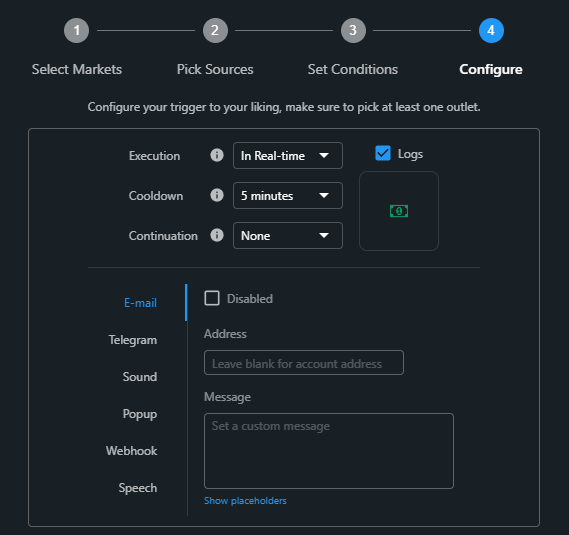

4. Configure

The last step is configuration.

Execution

Real-time — conditions are checked in real-time. You will have an alert immediately. On Bar Close — conditions are checked on bar close of the selected timeframe. You will have an alert once per timeframe.

Cooldown

Prevent alerts from being triggered repeatedly within a short time frame. It is the amount of time which has to pass before the alert can trigger again, after it was triggered. Each selected market has its own cooldown.

Continuation

The minimum amount of time between when conditions are first met and when the alert is actually triggered. During this entire time, the conditions must be met for every evaluation.

Logs

When checked - every triggered alert will be visible in the Alerts console.

Icon

Customize alert icon and its color. You can set different icons for Long and Short sides.

Notification types

There is a lot of possible notification options:

E-mail

Telegram message

Sound in the browser

Popup in the browser

Webhook to Url

Speech in the browser

You can activate all or few of them simultaneously.

Placeholders

When you receive notifications, you would like to have detailed information about the ticker, conditions of alert, time it triggered or about the indicator values.

If you want to see the exact indicator values which triggered the alert — you need to leave the “Message” area blank. This is a default setting.

If, instead, you want to see some custom message — you need to write something in the “Message” area or use Placeholders.

Placeholders give you a wide possibility to customize incoming messages.

For example, you can receive a message like this:

“Spot Double Overlay Bands

BTCUSDT 59000 LONG

Check BTC for a long!”

Where:

{{name}} name of your alert

{{symbol}} the ticker of the market used by TRDR

{{price}} current price

{{side}} long or short

{{message}} default formatted message

The message can be formatted by using html tags like <b>, <i>, <code>, <pre>.

Copying triggers between Long and Short Tabs

After the Long tab configuration is finished, you can just copy all markets, sources, conditions and configuration from the LONG tab to the SHORT tab.

To do it — go to the Short tab and click the corresponding link at the bottom of any step.

After copying, don't forget to make changes to the Short condition values. For example you need to add the minus “—” sign to the Order Book Depth values, etc.

Importing a shared alert

TRDR has a lot of already preconfigured, proven by time, shared alerts in the “Alerts” Telegram chat. Copy the alert link and paste it into your browser address bar. After importing an alert - save and start it from the Alerts console.

Last updated