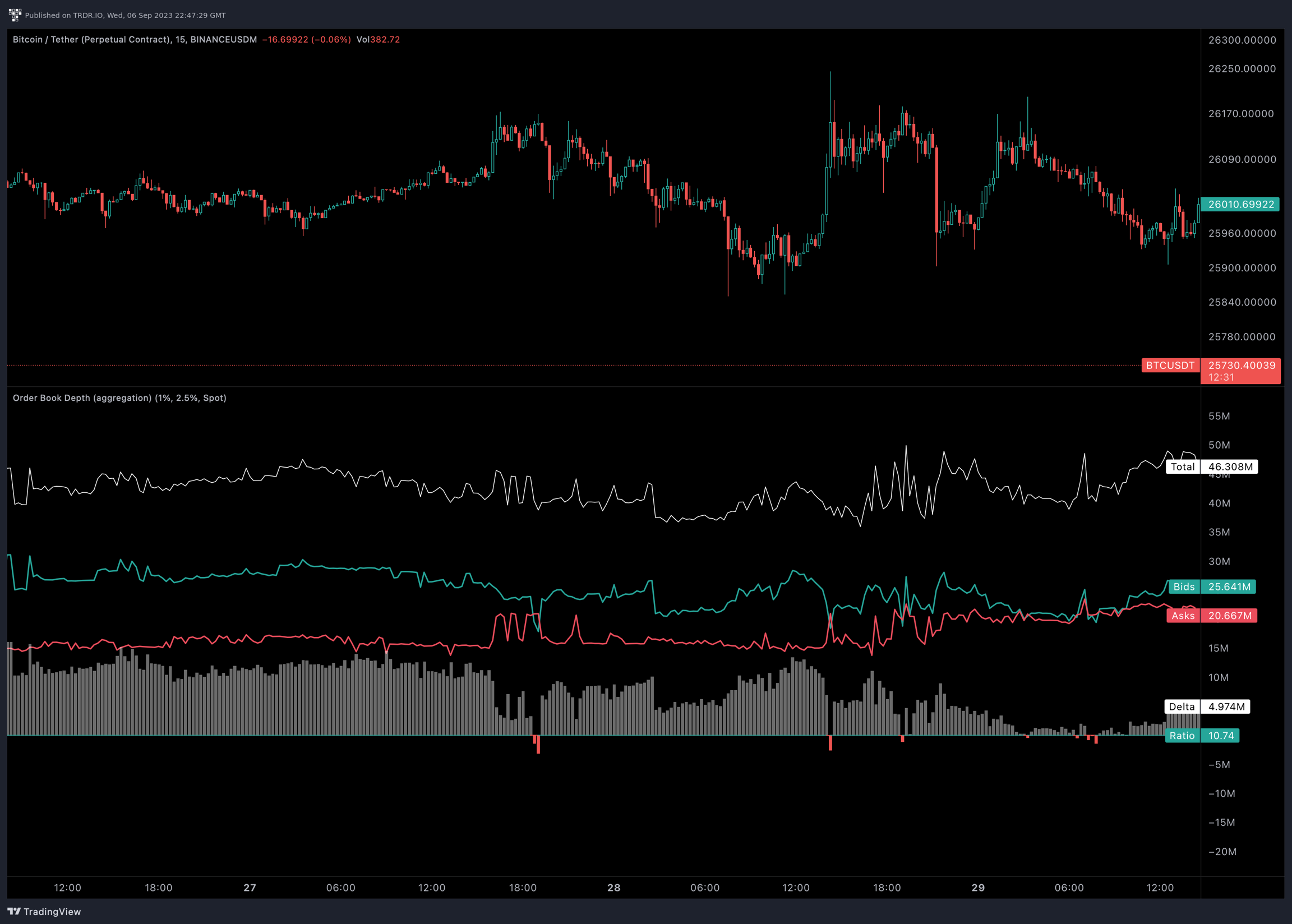

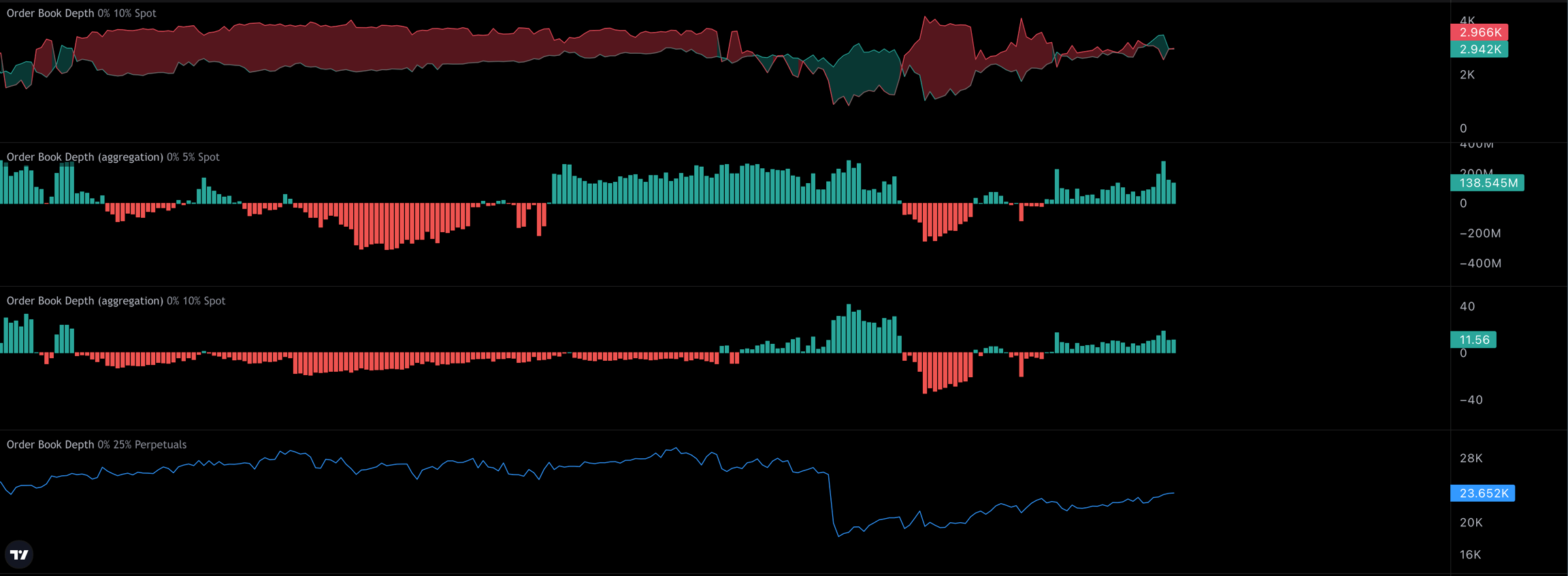

Order Book Depth

Key Features:

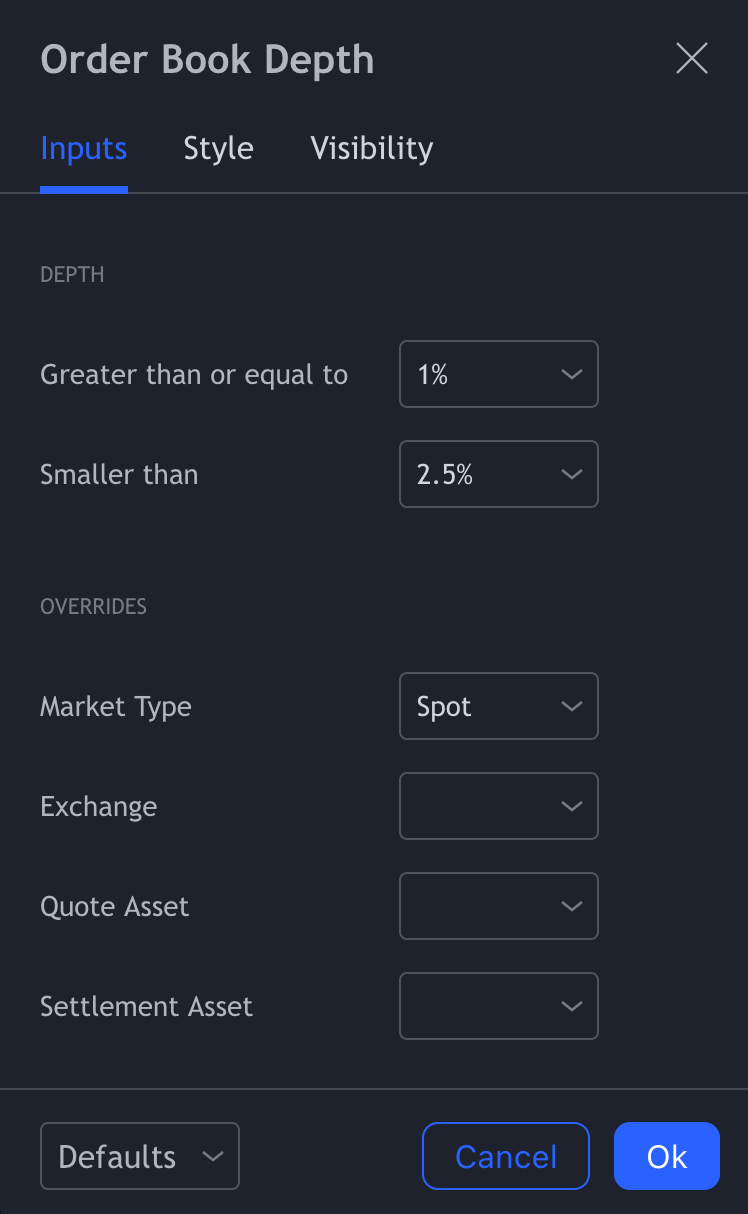

How to Use It:

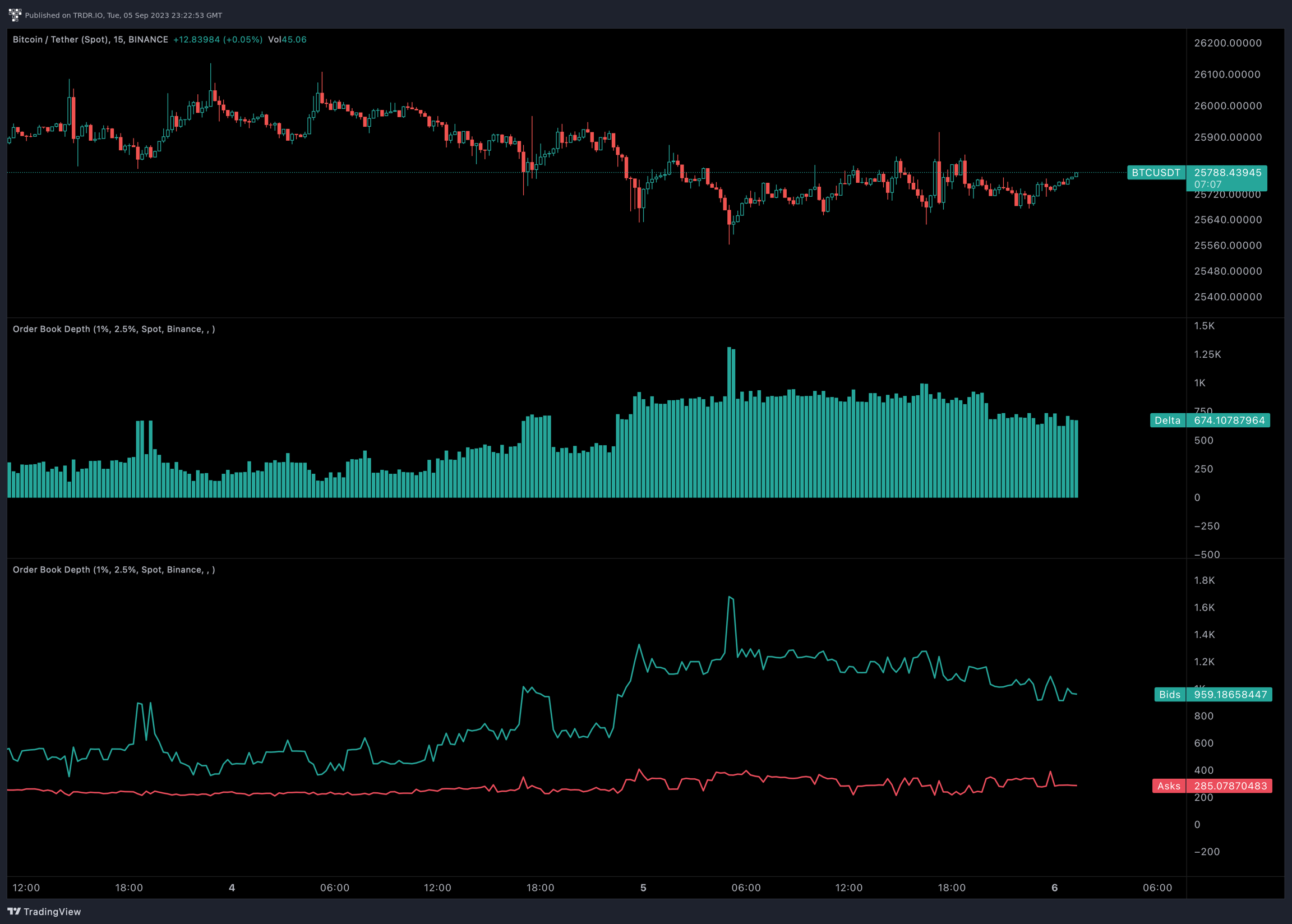

Overrides: If you choose 'spot,' the OBD data will only appear when you select a specific spot market. Different settings for different markets can be beneficial due to differences between Spot/Perpetuals/Futures markets.