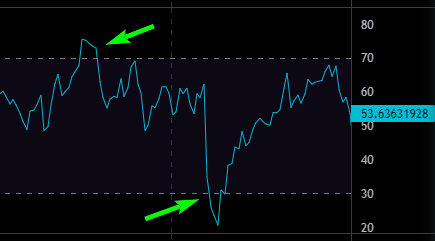

RSI Alert Example

Purpose

Automatically find the big price fluctuations by using Alerts widget and setting up RSI indicator with a period of 14 hours.

RSI - The Relative Strength Index (RSI), developed by J. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between zero and 100. Traditionally the RSI is considered overbought when above 70 and oversold when below 30. Signals can be generated by looking for divergences and failure swings.

Step-by-Step Implementation

2

3

4

5

Voila, we have finished setting up the RSI Alert!

Now save it and press the start icon in the console!