Funding Rate

Funding Rate:

In perpetual futures contracts, there's a mechanism to ensure that the contract's price remains close to the spot market price. This mechanism involves the payment of funding between long (buyers) and short (sellers) positions.

How Funding Rates Work:

The funding rate is a periodic payment exchanged between traders depending on the contract's premium or discount to the spot market.

If the perpetual contract is trading at a premium (higher than the spot price), traders with long positions pay funding to traders with short positions.

If the contract is at a discount (lower than the spot price), the short positions pay funding to the long positions.

Purpose of Funding Rates:

Market Balance: Funding rates help maintain balance in the market by providing an incentive for traders to take the side of the market that is less crowded.

Preventing Manipulation: The funding rate mechanism helps prevent market manipulation. For instance, if the contract is trading at a premium, traders who are long pay funding to those who are short, discouraging an overabundance of long positions.

Calculation:

The funding rate is typically calculated periodically, often every 8 hours, and is influenced by the difference between the contract's price and the spot market price.

Impact on Traders:

Traders need to be aware of funding rates as they can significantly impact the cost of holding a position.

If a trader is consistently on the side of the majority (e.g., holding a long position when most traders are long), they may end up paying funding regularly.

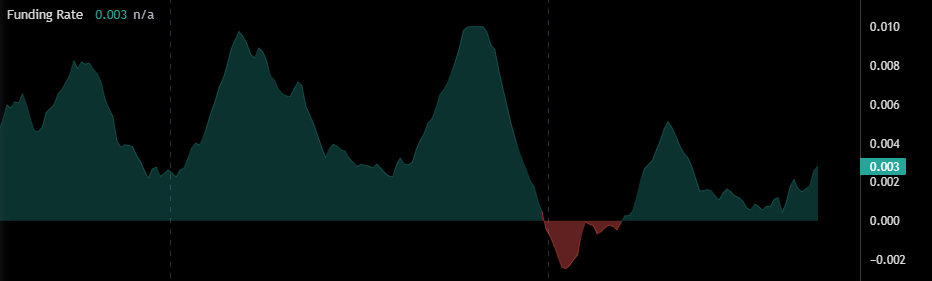

Conversely, traders taking the opposite side might receive funding. Funding rate indicators:

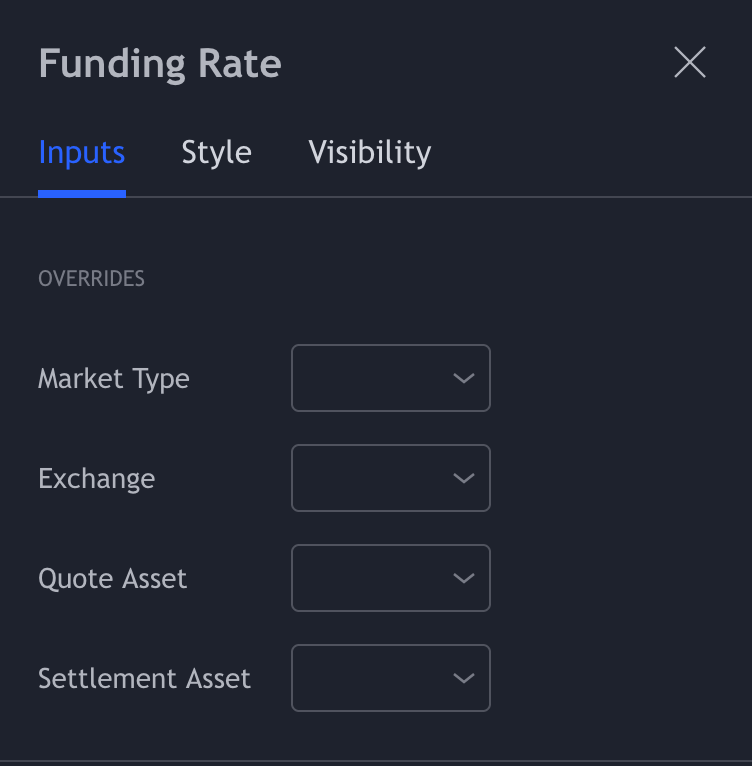

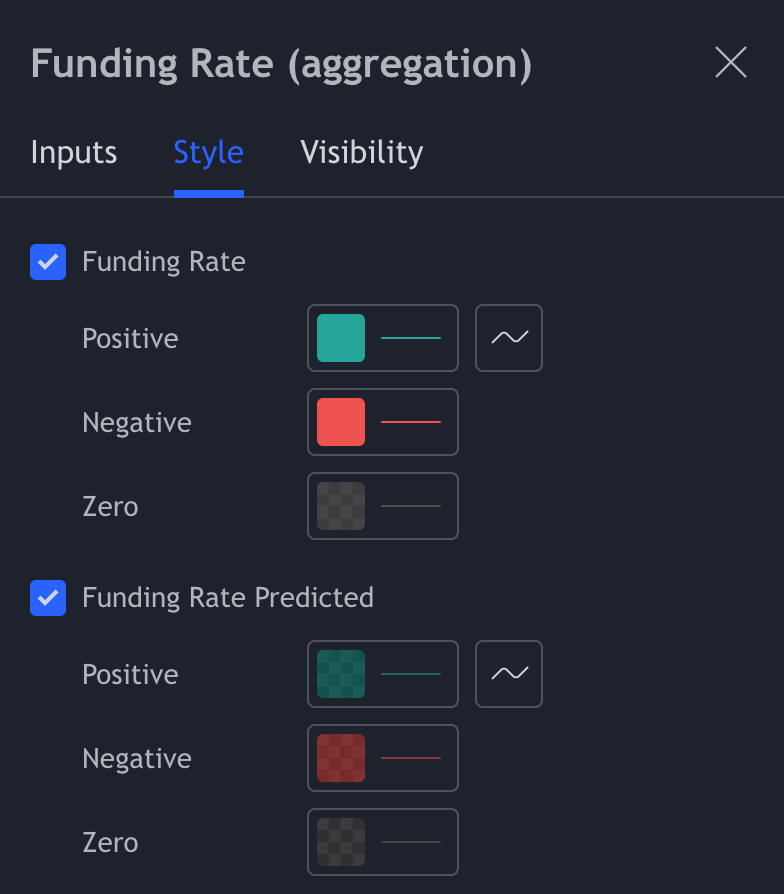

As shown in the pictures above, we offer an aggregated version. Covering the most relevant derivative exchanges. With the opportunity to filter on quote and settlement assets. A normal variant of the indicator is also available.