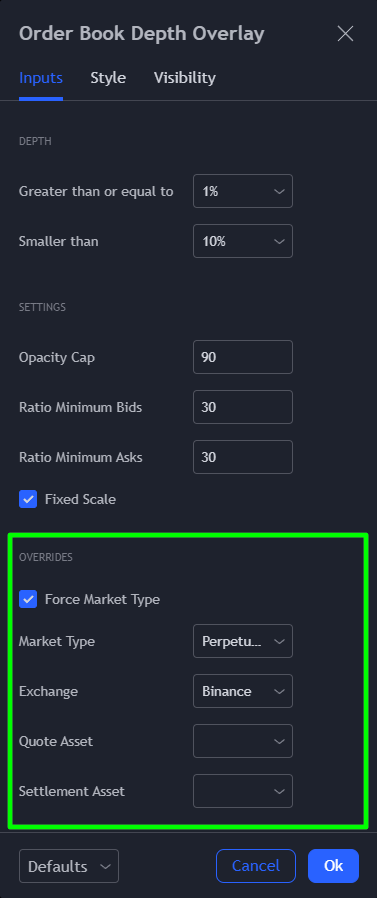

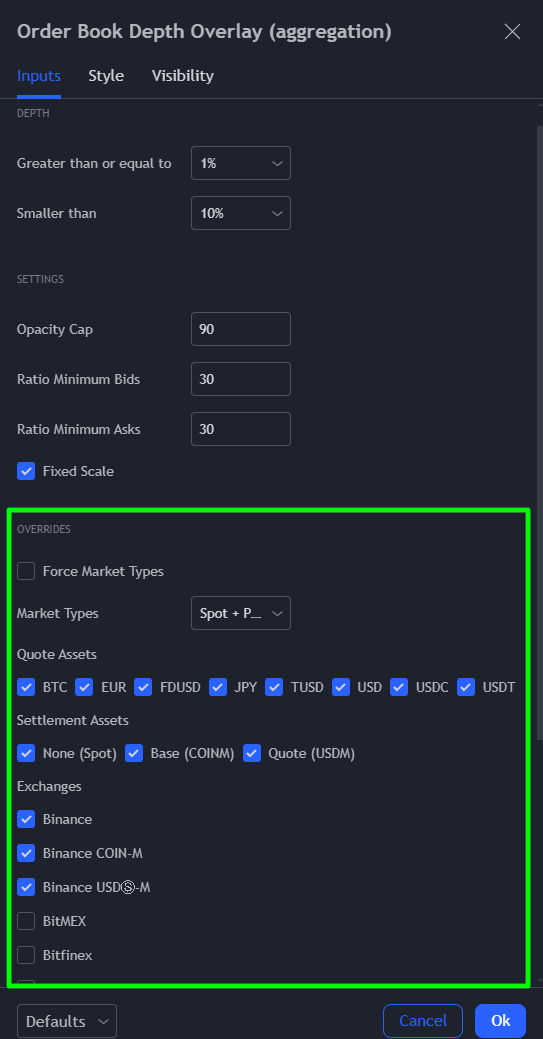

Indicator Overrides

The Overrides feature on TRDR allows traders to customize indicator settings by locking them to a specific market type, exchange, quote asset or settlement asset, regardless of the selected trading pair. This ensures consistency in analysis and better adaptability to different market conditions.

For the Aggregation indicators overrides settings are slightly different.

Force Market Type

All indicators have their market type and / or exchange overridden. For example, you could use the overlay indicator and set market type to "Perpetuals" and exchange to "Binance Futures" and it would stick to that, regardless of which pair you select. But if you just select perpetuals it will only show on a perpetual market. The ratios on spot markets are usually higher compared to perpetual markets. Why? Because the books are thicker (more liquid) on perpetual markets.

Market Type

Selection tool for different markets: Spot, Perpetuals, Futures.

Exchange

Choose between different exchanges.

Quote Asset

A quote asset, is one of the two assets involved in a trading pair. It is the second asset listed in the pair and is used to determine the price of the first asset, known as the base asset. Together, these two assets make up a trading pair. The quote asset is essentially the unit of measurement for pricing the base asset. When you see a trading pair like BTC/USD, where BTC is the base asset and USD is the quote asset, it means that the price of one Bitcoin is determined in terms of U.S. Dollars. In other words, if you want to buy or sell Bitcoin, you'll use U.S. Dollars as the reference currency to determine its value.

Settlement Asset

Settlement assets play a crucial role in finalizing and confirming transactions and ensuring that ownership of the traded assets is transferred between parties. Here are some examples of settlement assets in the cryptocurrency space: Spot: Select only spot markets for this indicator. Base: (COINM) COIN-margined contracts are denominated and settled in the underlying cryptocurrency. Quote: (Fiat & Stablecoins) USDT-margined contracts are denominated and settled in USDT.

Last updated